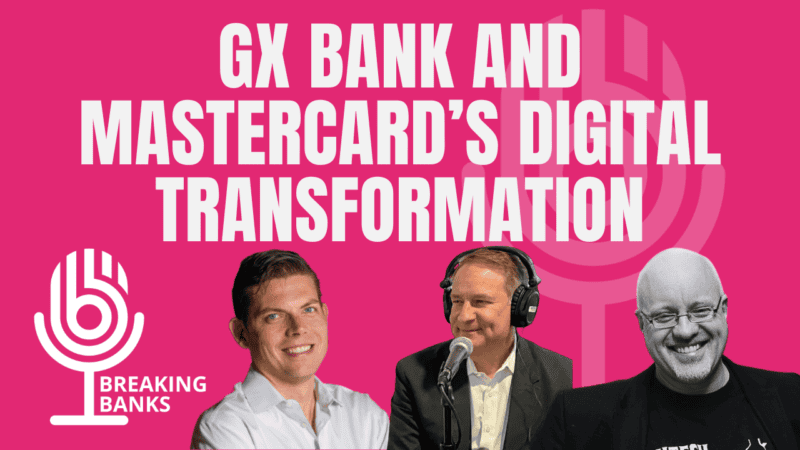

How Fintech Innovation is Powering the Growth of Mastercard and Revolut

The fintech industry continues to redefine how we think about money and banking, driving growth, inclusion, and cutting-edge innovation. At the forefront of this transformation, fintech innovation is shaping the future of financial services, with Mastercard and Revolut leading the charge. These industry pioneers offer valuable insights into leveraging technology, enhancing customer trust, and adapting…

Read More