The Digital Banking Revolution: The Rise of Challenger Banks

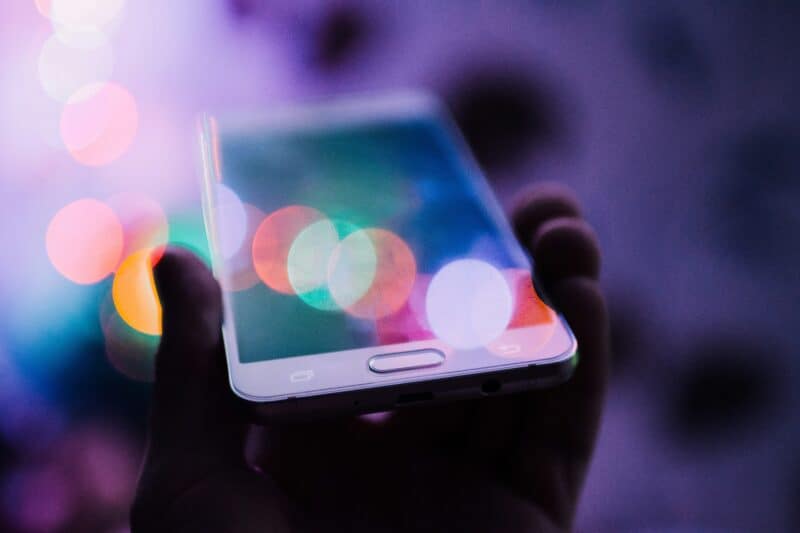

The digital banking revolution is transforming the way we manage our finances. Over the last decade, we’ve witnessed a significant shift away from traditional brick-and-mortar institutions towards digital-first banking experiences. Neobanks and challenger banks have entered the financial landscape, giving consumers more choices than ever before. These new players are not just providing an alternative…

Read More